Driving Financial Clarity and Growth for a Seafood Business

The Challenge: Laying the Financial Foundations for Growth

In February 2022, Brian Kilcullen of FD4 began working with a long-established family business specialising in fishing, seafood wholesale, and retail. The owners had ambitious plans to grow the business by expanding processing and storage capacity, and for the first time, enter the export market.

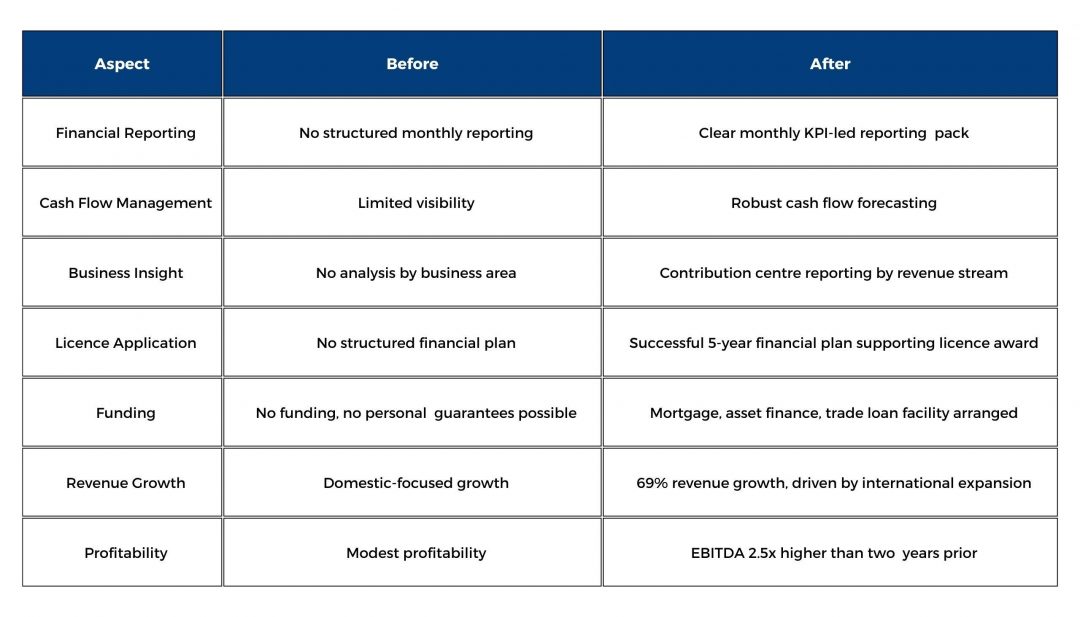

However, they faced several major challenges:

- A lack of financial visibility and management reporting, making decision-making difficult.

- The need for funding without personal guarantees – a significant hurdle for family-owned businesses.

- A lack of clarity on how different areas of the business contributed to profitability.

- The requirement to prepare detailed financials to support a critical licence application.

Brian was engaged as a Fractional FD to provide financial leadership, enable business growth, and support strategic funding efforts.

The Solution: Financial Structure, Reporting, and Funding Expertise

Brian focused on building financial reporting systems and unlocking funding to enable the business’s growth ambitions:

- Monthly financial reporting: Created a clear, concise monthly reporting pack tracking KPIs, financial performance, and forecasts to aid decision-making and business growth.

- Cash flow forecasting: Implemented dynamic cash flow forecasting to provide visibility and financial resilience.

- Business area analysis: Introduced contribution centre reporting, allowing the business to understand the profitability of different revenue streams.

- Financial planning for licensing: Prepared a detailed 5-year financial plan, helping the client successfully obtain a vital licence for operations.

- Funding strategy and execution:

- Secured a mortgage with NatWest to purchase a new factory.

- Arranged asset finance via Lombard for new plant and machinery.

- Negotiated a Trade Loan drawdown facility, offering flexible working capital without the need for personal guarantees.

- Arranged Trade Credit Insurance to give comfort to the bank and unlock funding.

Brian typically worked three days per month, providing focused, strategic CFO support while allowing the owners to concentrate on operational and sales growth.

The Outcome: Growth, Financial Resilience, and International Expansion

Brian’s involvement provided the financial structure and external funding necessary to fuel the company's growth, culminating in a remarkable transformation over two years.

Key Achievements

We have worked tirelessly on adding processing facilities and new export sales. The positive results from this wouldn’t have been achievable though without the bank funding. Having Brian to arrange and manage this for us whilst we focused on growth has been of vital importance. Brian has recently worked for us on another project with the aim of growing sales further.

If you want to secure growth, funding, or financial clarity for your business without risking your personal assets, get in touch today to learn how a Fractional FD can help.