Leading Refinancing & Merger for the UK’s 4th Largest Dairy

The Challenge: Navigating Financial Uncertainty & Securing Stability

In August 2020, David Bateman joined Medina, the UK’s fourth-largest dairy, as Interim CFO. The business was facing financial instability, heightened by the challenges of Covid and low margins. His mandate was clear—lead a critical refinancing process to stabilise the company and help position it to review strategic options including a potential merger.

Key challenges included:

- Urgent refinancing needs to ensure continuity of trading.

- Managing lender relationships, including transitioning from incumbent lenders.

- Operational efficiency improvements to optimise costs and maintain effectiveness.

The Solution: Strategic Refinancing & Financial Leadership

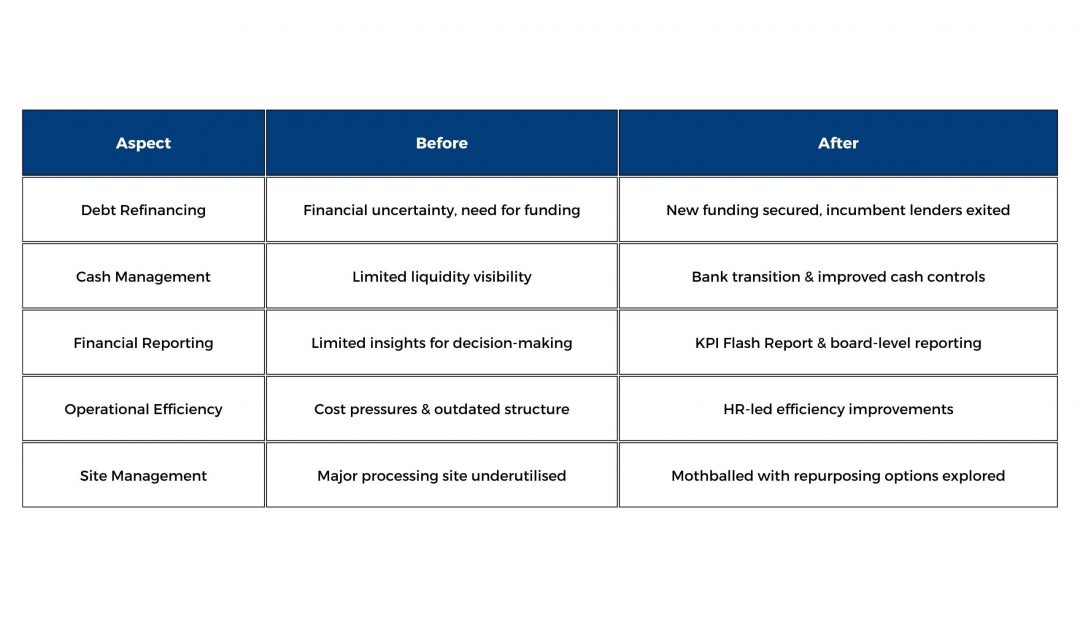

Over almost two years, David worked closely with the company’s leadership team, delivering key financial and operational improvements:

🔹 Successfully led a complex debt funding process, working with corporate finance advisors to secure new funding and exit incumbent lenders.

🔹 Implemented an "amend & extend" agreement on an existing facility to buy time and maintain liquidity.

🔹 Managed the transition of Clearing Banks from NatWest to Barclays, overseeing cash management throughout the business.

🔹 Improved financial reporting and visibility, introducing a new KPI Flash Report to share critical financial insights.

🔹 Led financial communications, presenting regular updates at Management and Board meetings.

🔹 Managed year-end processes with external auditors, ensuring compliance and financial integrity.

🔹 Worked with HR on cost-saving efficiencies, restructuring roles while maintaining operational effectiveness.

🔹 Oversaw the financial aspects of mothballing of a major milk processing site, exploring repurposing options for the facility and workforce.

The Outcome: A Stabilised Business & Successful Merger

Through strategic refinancing and operational improvements, David successfully stabilised Medina, allowing the business to continue trading and, ultimately, to fully prepare for completion of a merger in mid-2022. His leadership provided the financial clarity and structural efficiencies needed to support long-term success.

Key Results

Strategic Finance Leadership in Action

This case highlights the value of strong financial leadership in challenging times. If your business is facing financial uncertainty or preparing for growth and transformation, expert guidance can make all the difference.

To learn more about how a Fractional FD can help, get in touch today.