Preparing Phoenix Scientific Industries for a Successful Retirement Sale

The Challenge: Turning a Post-Covid Struggle into a Strategic Sale

In 2021, Alasdair Smith joined Phoenix Scientific Industries Ltd, a £5m turnover SME specialising in metal powder processing equipment, powder production, and R&D projects. Emerging from the Covid-19 pandemic, the business faced significant operational and financial challenges. The Directors, looking towards retirement, aimed to prepare the business for sale — but the company was far from ready.

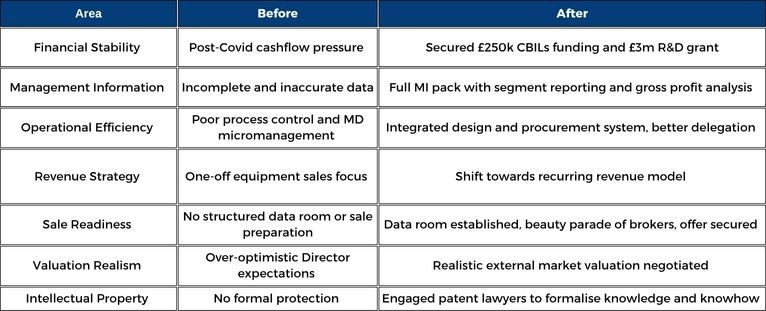

Key challenges included:

- Severe cashflow constraints following Covid-19.

- Restarting business operations after a year-long pause.

- Lack of historical data and structured management information.

- No coherent strategic planning history to support a sale.

- Unrealistic valuation expectations by the Directors.

- Absence of patents or formal protection for the company’s intellectual property.

Alasdair was brought in as a part-time Financial Director to stabilise the business, professionalise operations, and prepare it for an eventual exit.

The Solution: Financial and Operational Transformation

Alasdair's approach was not just about improving short-term cashflows; it was about professionalising the business to achieve an optimal exit value. Here's how he helped reposition Phoenix Scientific Industries:

- Stabilised cashflow: Secured £250k in CBILs funding from a major bank.

- Unlocked growth funding: Secured a £3m Government Grant for R&D activities.

- Professionalised management information: Introduced a segment-based financial reporting system highlighting gross profit by customer and division.

- Operational overhaul: Implemented an integrated procurement, design, and build system, exposing inefficiencies and improving delivery.

- Process improvement: Enhanced powder processing machine setups, significantly reducing aborted run time.

- Strategic growth plan: Developed a five-year plan shifting focus from one-off equipment sales to recurring revenue streams.

- Sale preparation: Initiated a data collection process for historic knowledge, engaged patent lawyers, and prepared financial projections.

- Market engagement: Organised a beauty parade of sales agents and engaged directly with a trade buyer.

- Negotiated deal terms: Secured a trade offer , including structured earn-out terms.

Despite challenges around data completeness and valuation discrepancies, Alasdair steered the business towards an achievable, realistic sale framework.

The Outcome: Business Transformation and Strategic Positioning

Through strategic financial leadership, Alasdair repositioned Phoenix Scientific Industries for a retirement sale, improving business operations, financial controls, and future growth prospects.

Key Achievements

This case study highlights how expert financial leadership, operational improvements, and strategic planning can transform an SME facing post-crisis difficulties into a business ready for sale.

If you are looking to stabilise, grow, or prepare your business for a successful sale, get in touch today to learn how a Fractional FD can help.