Successfully Managing a Complex Merger for the UK’s 4th Largest Dairy

The Challenge: Navigating a High-Stakes Merger Process

Following the successful refinancing of Medina, the UK’s fourth-largest dairy, the company moved towards a critical merger. This process required regulatory approval from the Competition and Markets Authority (CMA), extensive financial and legal coordination, and seamless operational integration.

Key challenges included:

- Securing CMA approval for the merger, ensuring compliance with regulatory requirements.

- Managing complex stakeholder communications, including regulators, legal teams, and lenders.

- Ensuring financial transparency, forecasting, and reporting throughout the transition.

David Bateman was responsible for leading the financial and operational aspects of this high-stakes process.

The Solution: Strategic Financial & Merger Leadership

David played a pivotal role in securing CMA approval and preparing the business for a seamless transition. His key contributions included:

🔹 Primary point of contact for the CMA and Monitoring Trustee, ensuring all regulatory requirements were met.

🔹 Coordinated responses to queries from the CMA, Board, Management teams, and advisory firms, ensuring all stakeholders were aligned.

🔹 Provided critical input into the Joint Venture (JV) Agreement and transaction documents, ensuring financial schedules were accurate and complete.

🔹 Liaised with HMRC where necessary, ensuring compliance and tax efficiency.

🔹 Maintained business stability during the merger process, providing directors with key financial insights, including margin reporting, cash management, and forecasting via a Short-Term Cash Flow Model.

🔹 Led financial planning for post-merger integration, ensuring process synergies and organizational readiness.

🔹 Managed a central cost schedule, tracking incurred and expected merger-related expenses.

The Outcome: A Seamless, CMA-Approved Merger

David’s expertise ensured that Medina successfully obtained CMA approval in March 2022, paving the way for legal completion of the merger. His structured approach provided the company with financial stability during the transition while optimizing processes for post-merger efficiency.

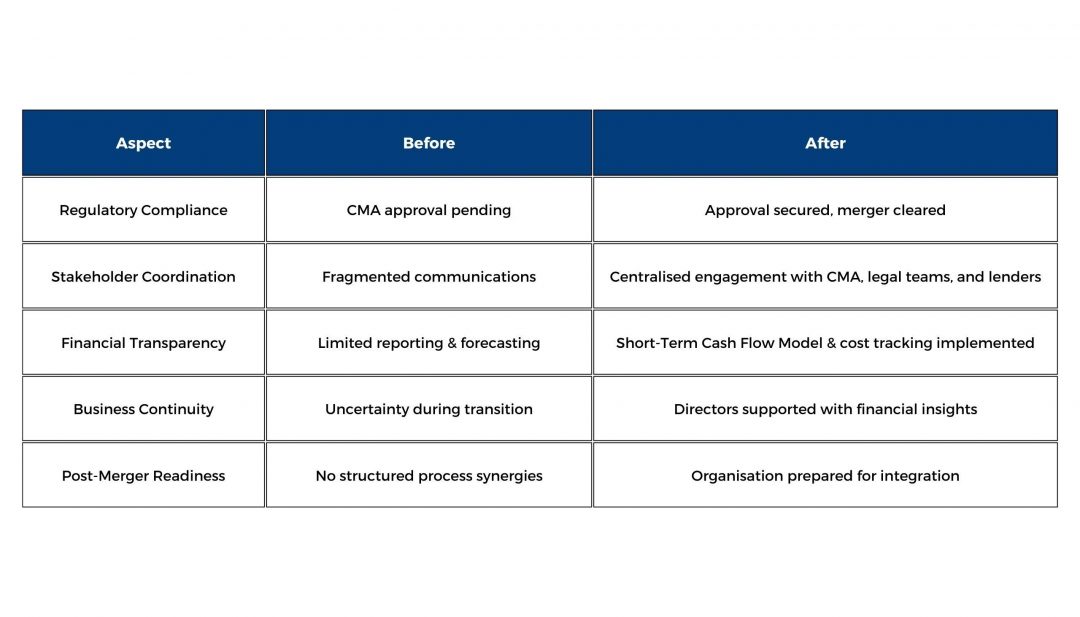

Key Results

Driving Financial & Operational Success Through Mergers

This case highlights how strategic financial leadership ensures a smooth, compliant, and well-structured merger process. If your business is preparing for a transaction, regulatory approval, or integration, expert financial guidance is essential.

To learn how a Fractional FD can provide the expertise needed for complex financial transformations, get in touch today.