Transforming Financial Management and Exit Readiness for a £25M Construction Business

The Challenge: Cash Flow Uncertainty & Weak Financial Leadership

A £25 million construction business was struggling with persistent short term cash flow crises and slow, poor quality management reporting. The Managing Director was concerned that the finance function wasn’t providing the insights needed to manage the business effectively—especially as the company was considering a potential sale in the future.

Key issues included:

- Limited cash flow visibility – short term forecasts were limited to two weeks ahead and required excessive review by the Managing Director.

- Delayed management reporting – monthly accounts arrived too late to support decision-making by the leadership team.

- Lack of financial leadership – the finance team struggled to provide accurate, forward-looking insights and had no plan to improve.

Brought in as a Fractional FD, Richard Taylor quickly identified these challenges and developed a structured plan to strengthen financial management, improve cash flow visibility, and prepare the business for a future sale.

The Solution: Strengthening Finance for Stability & Growth

Over several months, Richard worked closely with the leadership team to:

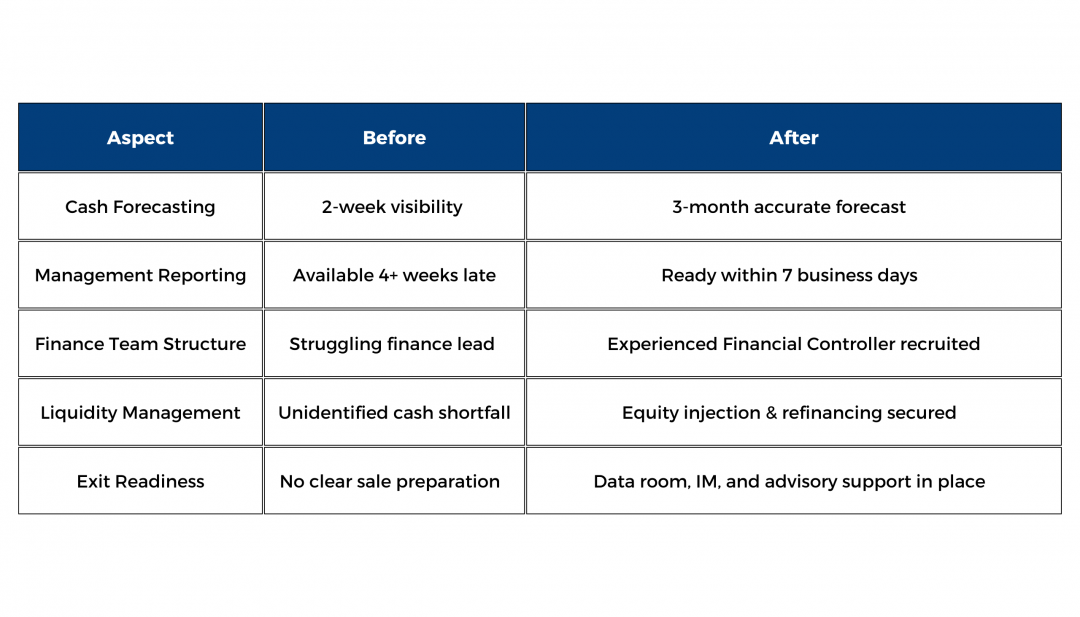

- Upgrade cash forecasting – extending visibility from 2 weeks to 3 months for better financial planning.

- Secure financial stability – leading negotiations for financial support from the shareholders to address the short term challenges identified

- Improve management reporting – reducing reporting turnaround time from over 3 weeks to just 7 business days.

- Enhance working capital management – implementing new controls to optimise cash flow and reduce financial strain and asset refinancing to free up cash to support growth..

- Restructure the finance team – replacing the struggling finance lead with an experienced Financial Controller to better support the company’s needs.

Preparing for a Business Sale

With these improvements in place, the business became more financially resilient and better positioned for future growth. When shareholders decided to move forward with an exit, Richard played a key role in ensuring a smooth sales process by:

🔹 Developing an Information Memorandum to present the business to potential buyers.

🔹 Managing the relationship with a Big 4 advisory firm, ensuring alignment on valuation and positioning.

🔹 Overseeing the creation of a data room, ensuring all financial and operational data was available for due diligence.

The Outcome: A Stronger, Sale-Ready Business

By improving financial visibility, upgrading the finance team capability, and securing a stronger financial position, Richard helped the business not only overcome its immediate cash flow challenges but also position itself as a well-managed, attractive acquisition target.

Key Results

The business leadership team and the shareholders clearly recognised the value of a clearer financial picture, and my recommendations led to a more confident, forward-looking strategy which enabled them to pursue their exit from the business

Building Value, Securing the Future

This case highlights how proactive financial leadership can transform a business—whether it’s overcoming short-term cash challenges or preparing for a successful sale.

If your business needs stronger financial oversight, improved reporting, or support in planning for the future, let’s have a conversation about how a Fractional FD can help.

Hiring a fractional FD was critical for us – Richard’s work to improve our understanding of cash and his success in strengthening the finance team, provided the stability and confidence to enable me to secure the best exit for the business.

Craig M

Managing Director