Have we learned the lessons from the last Global Recession?

Filed under:

Have we learned the lessons from the last global recession? A review of ‘Can We Avoid Another Financial Crisis’ by Professor Steve Keen

In the current environment of sustained high levels of global economic growth, low inflation and high employment you could be forgiven for thinking that we have in some way learned our lessons from the past and that we are better prepared to react to any future financial crisis.

However, in his short book Can We Avoid Another Financial Crisis?, Professor Steve Keen sets out to explain what went wrong after 2007 and why it will happen again. The answer is a simple one, credit (here meaning ‘the change in private debt’), but the story of why it has been missed, and why it will happen again, is an important part of the problem. Crucially, many of the mainstream economists are beginning to admit that the ideas he puts forward here, and those of the shoulders he stands on, are right.

From Triumph to Crisis

Despite using models that could not generate depressions – models that could not explain 1929 and its Thirties aftermath – economists and bankers were confident in 2007. The US Federal Reserve even went so far as to state that the outlook was “a pretty benign picture, despite all the financial turmoil”. The period they called The Great Moderation held all in thrall.

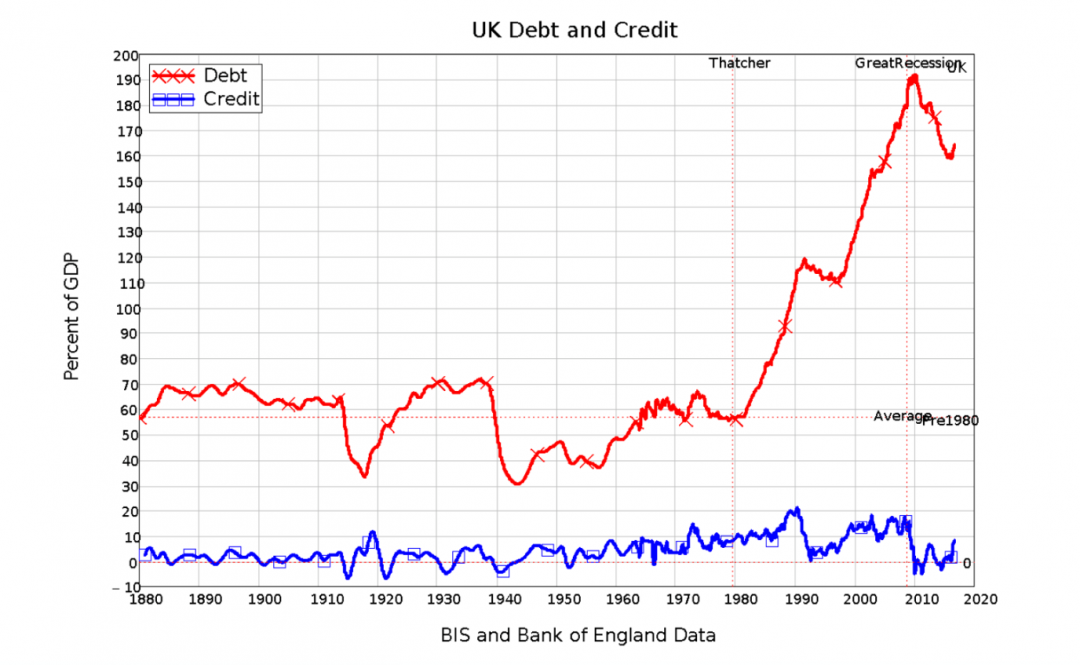

Quite a few things should have given them pause – their models, for a start, and this chart, for another.

The models in use excluded money and credit. They assumed natural equilibrium in a non-equilibrium world. It was not possible, using these models, to recreate a depression. Yet depressions happened. These models were and are bust.

Complexity

Keen has been working on models that take into account money, credit and non-linear cycles, following on from Minsky and others. He has demonstrated how credit grows to unsustainable levels, while producing an apparent ‘calm before the storm’ – that Great Moderation. Eventually the debt reaches a point where it is clear more cannot be serviced, and it is enough at that point for the slowing, the rate of change to fall, to produce a recession.

Why is this? Because credit injects money into the economy. With private debt at 150% of GDP that amounts to an awful lot of money being added. At first it creates growth and optimism, and makes the incumbent politicians look like good managers of the economy. Taken to the extreme, eventually all money would be being used to service the debt to the banks. At some point, long before that, the edifice has to collapse.

The smoking gun

What next? Keen names several economies with extremely high levels of private debt as candidates for a fall – China, Australia, Ireland, Hong Kong, Canada amongst others. What can they look forward to? An economy going backwards, then flatlining, possibly for decades, as in Japan. Political turmoil as the incumbents lose their jobs, while unemployment and poverty may cause problems of their own. In the UK, a mix of Quantitative Easing, government spending and a return to credit have got us past the worst of it – for now.

Conclusions

Given we are where we are, what solutions exist? Helicopter money; debt forgiveness; commerce without ‘state’ money (Bitcoin, amongst other things); temporary government spending to replace the credit shock; rules to stop lending causing asset bubbles – all have these have their problems, as Keen shows us. He suggests a Debt Jubilee, combining helicopter money and debt forgiveness, but this itself has its own issues.

Keen is cynical about our ability to address the problem. Mainstream economists are agreeing that ‘some’ of their theory is wrong, but rationalising it away and clinging to revised versions of their old, bust models. Politicians are never going to be brave enough to spoil the party, preferring to feed Goldilocks or arrive after the fall and pick up the pieces, blaming their predecessors.

There is data and other support info for the book on www.Profstevekeen.com, while Steve Keen blogs and is looking for funding to extend research in this area at www.Patreon.Com/profstevekeen.

It’s a good book. It doesn’t have the full answer, but it is an important step forward from where we were. I strongly recommend reading it, especially ahead of an election.